All Categories

Featured

Table of Contents

- – How do I exit my Real Estate Investment Funds ...

- – What is the difference between Real Estate Cro...

- – What is a simple explanation of Accredited In...

- – What is Real Estate Development Opportunities...

- – How long does a typical Real Estate Investme...

- – What is a simple explanation of Accredited I...

Rehabbing a residence is thought about an active financial investment approach. On the various other hand, easy actual estate investing is great for financiers that want to take a less engaged technique.

With these techniques, you can appreciate easy income over time while permitting your financial investments to be taken care of by a person else (such as a residential or commercial property administration business). The only thing to keep in mind is that you can lose out on several of your returns by employing another person to take care of the investment.

An additional factor to consider to make when selecting a realty investing approach is straight vs. indirect. Comparable to energetic vs. easy investing, direct vs. indirect refers to the degree of participation required. Straight investments include in fact buying or taking care of homes, while indirect approaches are much less hands on. REIT investing or crowdfunded residential properties are indirect real estate financial investments.

Register to attend a FREE on-line property class and find out exactly how to start investing in property.] Several capitalists can obtain so caught up in identifying a property kind that they don't know where to begin when it concerns discovering an actual building. As you familiarize yourself with various home kinds, also be certain to discover where and just how to discover each one.

How do I exit my Real Estate Investment Funds For Accredited Investors investment?

There are tons of properties on the marketplace that fly under the radar because financiers and buyers don't understand where to look. Several of these buildings experience bad or non-existent marketing, while others are overpriced when noted and as a result stopped working to get any type of focus. This means that those investors happy to arrange through the MLS can locate a selection of investment opportunities.

In this manner, financiers can regularly track or be informed to brand-new listings in their target location. For those asking yourself how to make connections with realty representatives in their particular areas, it is an excellent concept to participate in local networking or real estate occasion. Investors searching for FSBOs will additionally discover it useful to deal with a realty representative.

What is the difference between Real Estate Crowdfunding For Accredited Investors and other investments?

Financiers can likewise drive via their target areas, seeking indicators to locate these buildings. Remember, recognizing homes can require time, and capitalists need to be prepared to use multiple angles to safeguard their following deal. For financiers living in oversaturated markets, off-market buildings can stand for a chance to get ahead of the competitors.

When it comes to trying to find off-market residential or commercial properties, there are a couple of resources financiers should inspect initially. These consist of public documents, real estate auctions, dealers, networking events, and specialists. Each of these resources stands for an unique opportunity to locate properties in an offered area. As an example, dealers are often familiar with newly rehabbed buildings available at reasonable rates.

What is a simple explanation of Accredited Investor Real Estate Investment Groups?

After that there are repossessions. In spite of many proclamations in the news that repossessions are disappearing, data from RealtyTrac proceeds to reveal spikes in activity around the country. Years of backlogged repossessions and increased motivation for financial institutions to repossess could leave much more foreclosures up for grabs in the coming months. Investors looking for foreclosures ought to pay mindful focus to paper listings and public documents to discover potential buildings.

You should consider buying property after finding out the different benefits this property needs to supply. Historically, genuine estate has actually carried out well as a property course. It has a favorable relationship with gdp (GDP), implying as the economic situation expands so does the need genuine estate. Normally, the regular demand supplies property lower volatility when compared to various other investment types.

What is Real Estate Development Opportunities For Accredited Investors?

The reason for this is because real estate has low connection to various other investment types hence offering some protections to investors with other possession kinds. Different sorts of genuine estate investing are related to various degrees of danger, so make certain to find the ideal investment technique for your goals.

The procedure of getting property includes making a down settlement and funding the remainder of the sale rate. Consequently, you only pay for a tiny portion of the property up front yet you regulate the entire financial investment. This form of utilize is not readily available with other financial investment kinds, and can be used to additional grow your financial investment portfolio.

Due to the large range of choices available, several capitalists most likely locate themselves wondering what actually is the best genuine estate investment. While this is a simple concern, it does not have a straightforward response. The finest kind of investment building will certainly depend upon many factors, and investors should take care not to dismiss any type of choices when browsing for potential bargains.

This post explores the possibilities for non-accredited financiers wanting to venture right into the profitable world of genuine estate (Private Real Estate Deals for Accredited Investors). We will explore different investment methods, regulatory factors to consider, and approaches that empower non-accredited individuals to harness the possibility of property in their financial investment profiles. We will certainly additionally highlight how non-accredited investors can work to end up being certified capitalists

How long does a typical Real Estate Investment Funds For Accredited Investors investment last?

These are normally high-net-worth people or companies that satisfy accreditation needs to trade private, riskier financial investments. Income Requirements: People should have an annual earnings going beyond $200,000 for two successive years, or $300,000 when combined with a partner. Internet Worth Demand: A total assets going beyond $1 million, omitting the key home's worth.

Investment Knowledge: A clear understanding and recognition of the threats related to the financial investments they are accessing. Documents: Ability to supply monetary declarations or other documents to confirm earnings and total assets when requested. Real Estate Syndications require certified investors because enrollers can only enable certified capitalists to register for their financial investment opportunities.

What is a simple explanation of Accredited Investor Property Investment Opportunities?

The very first usual misunderstanding is as soon as you're a certified financier, you can keep that condition indefinitely. To end up being an accredited capitalist, one should either strike the income standards or have the net well worth demand.

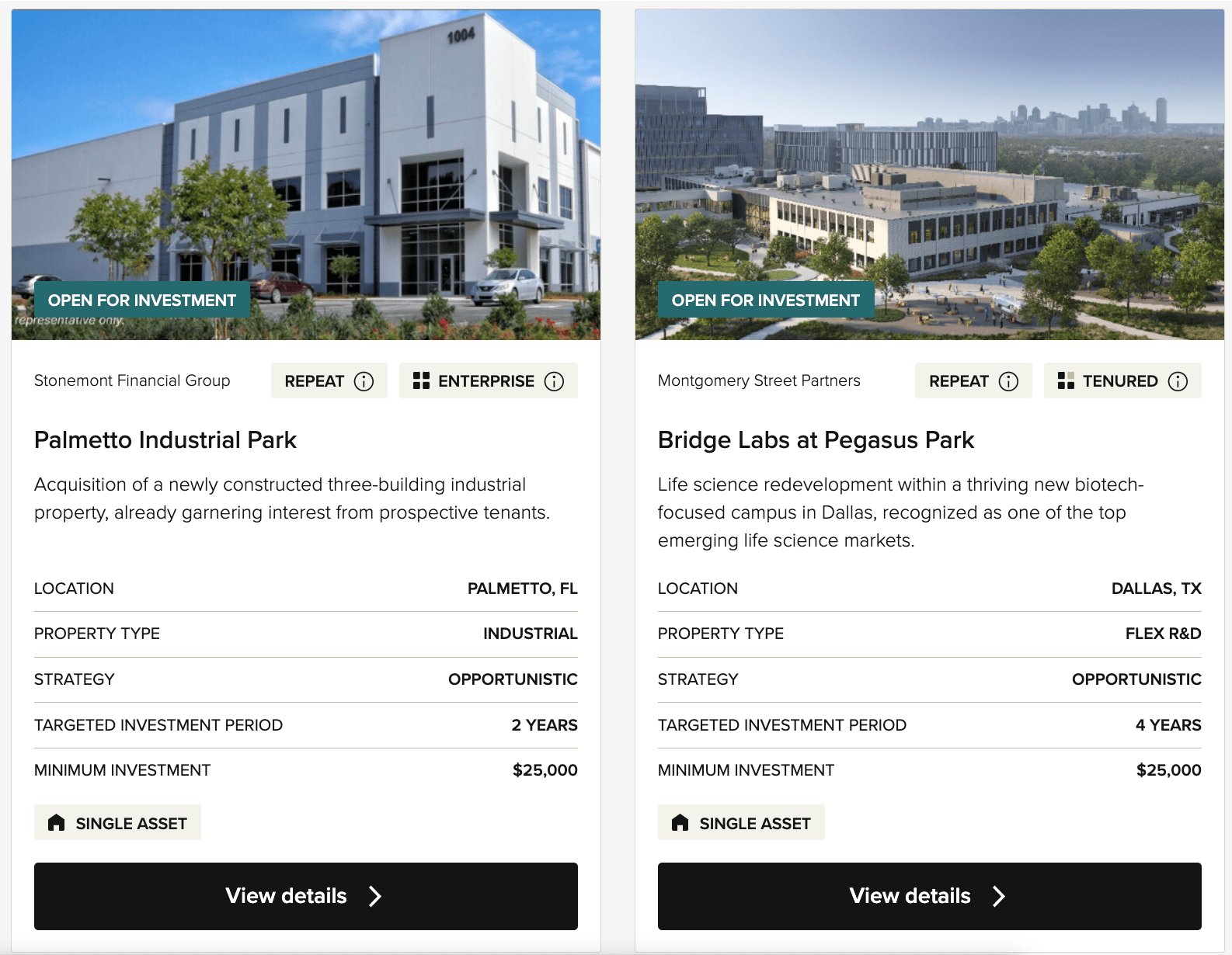

REITs are appealing since they generate more powerful payouts than typical stocks on the S&P 500. High return dividends Portfolio diversity High liquidity Dividends are taxed as common income Level of sensitivity to rate of interest Risks linked with details homes Crowdfunding is a technique of online fundraising that includes asking for the general public to add cash or start-up resources for brand-new tasks.

This permits entrepreneurs to pitch their ideas directly to everyday net users. Crowdfunding supplies the ability for non-accredited investors to come to be investors in a business or in a realty property they would not have actually had the ability to have access to without certification. One more benefit of crowdfunding is profile diversity.

In numerous cases, the financial investment candidate needs to have a track record and is in the infancy stage of their project. This can imply a higher threat of losing a financial investment.

Table of Contents

- – How do I exit my Real Estate Investment Funds ...

- – What is the difference between Real Estate Cro...

- – What is a simple explanation of Accredited In...

- – What is Real Estate Development Opportunities...

- – How long does a typical Real Estate Investme...

- – What is a simple explanation of Accredited I...

Latest Posts

Foreclosed Tax Properties

Property Tax Delinquent Lists

Learn Tax Lien Investing

More

Latest Posts

Foreclosed Tax Properties

Property Tax Delinquent Lists

Learn Tax Lien Investing