All Categories

Featured

Table of Contents

Selecting to buy the realty market, supplies, or other basic sorts of assets is sensible. When choosing whether you ought to invest in accredited financier chances, you need to balance the trade-off you make in between higher-reward possible with the absence of coverage demands or regulative transparency. It should be stated that exclusive positionings entail higher levels of danger and can frequently stand for illiquid investments.

Specifically, absolutely nothing right here ought to be interpreted to state or imply that past outcomes are an indicator of future efficiency nor need to it be translated that FINRA, the SEC or any various other safeties regulatory authority accepts of any of these securities. Furthermore, when evaluating personal placements from sponsors or business using them to approved capitalists, they can give no guarantees revealed or suggested as to precision, efficiency, or results obtained from any kind of details given in their conversations or presentations.

The firm needs to supply details to you via a record called the Exclusive Placement Memorandum (PPM) that provides a much more in-depth description of expenses and risks connected with joining the investment. Passions in these bargains are only used to individuals that certify as Accredited Investors under the Securities Act, and a as specified in Area 2(a)( 51 )(A) under the Firm Act or an eligible staff member of the monitoring firm.

There will not be any public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were known for their market-beating efficiencies. Some have actually underperformed, especially throughout the financial situation of 2007-2008. This alternate investing approach has a distinct way of operating. Usually, the manager of a mutual fund will reserve a section of their readily available possessions for a hedged bet.

How do I choose the right Accredited Investor Property Portfolios for me?

As an example, a fund supervisor for an intermittent sector might commit a part of the possessions to supplies in a non-cyclical field to balance out the losses in instance the economy containers. Some hedge fund supervisors utilize riskier strategies like using obtained money to acquire more of a property just to multiply their potential returns.

Similar to mutual funds, hedge funds are professionally taken care of by job investors. Hedge funds can use to various investments like shorts, choices, and by-products - Accredited Investor Property Portfolios.

What types of Accredited Investor Real Estate Partnerships investments are available?

You might choose one whose investment philosophy straightens with yours. Do keep in mind that these hedge fund cash managers do not come inexpensive. Hedge funds generally bill a cost of 1% to 2% of the assets, in addition to 20% of the profits which works as a "performance charge".

High-yield financial investments draw in several capitalists for their capital. You can buy a possession and obtain compensated for holding onto it. Accredited financiers have much more chances than retail financiers with high-yield financial investments and past. A higher range offers certified investors the possibility to get greater returns than retail investors. Accredited capitalists are not your common capitalists.

Real Estate Investment Partnerships For Accredited Investors

You need to meet at the very least one of the following criteria to become a recognized investor: You have to have more than $1 million total assets, omitting your main residence. Company entities count as accredited investors if they have more than $5 million in assets under monitoring. You must have a yearly earnings that surpasses $200,000/ year ($300,000/ year for partners filing with each other) You must be an authorized investment expert or broker.

As an outcome, accredited capitalists have much more experience and money to spread out throughout possessions. The majority of capitalists underperform the market, consisting of recognized investors.

In enhancement, capitalists can construct equity via favorable money flow and home recognition. Real estate homes call for significant maintenance, and a great deal can go incorrect if you do not have the right group.

Who offers the best Commercial Property Investments For Accredited Investors opportunities?

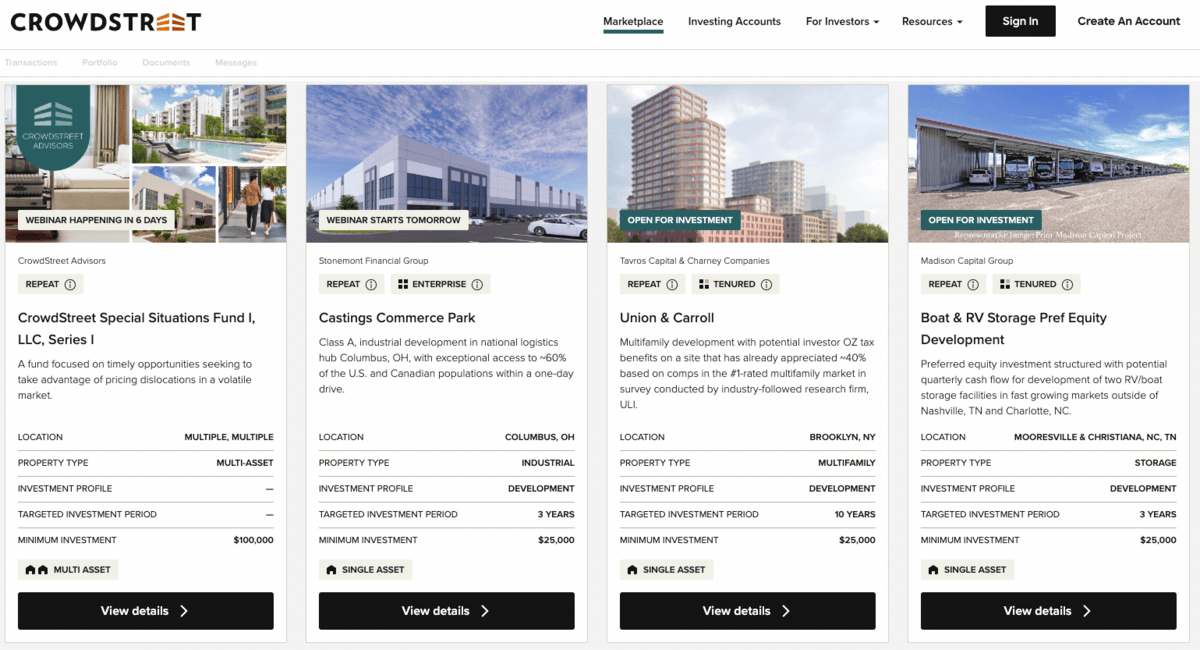

The enroller locates investment possibilities and has a group in area to deal with every responsibility for the home. Property syndicates pool money from accredited investors to get buildings aligned with established goals. Exclusive equity realty allows you purchase a team of properties. Approved financiers pool their cash together to finance acquisitions and property advancement.

Realty investment company should distribute 90% of their taxable income to shareholders as returns. You can deal REITs on the stock exchange, making them a lot more liquid than many investments. REITs enable investors to diversify rapidly throughout many property courses with extremely little funding. While REITs additionally turn you right into an easy capitalist, you obtain more control over important choices if you sign up with a real estate organization.

Accredited Investor Property Portfolios

The owner can make a decision to carry out the exchangeable option or to sell before the conversion occurs. Exchangeable bonds permit investors to acquire bonds that can become stocks in the future. Investors will profit if the supply price increases considering that exchangeable financial investments provide more attractive entry factors. However, if the stock rolls, financiers can opt against the conversion and secure their funds.

Latest Posts

Foreclosed Tax Properties

Property Tax Delinquent Lists

Learn Tax Lien Investing